UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a party other than the Registrant o

|

| | | | | | | |

| Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

Surgery Partners, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | | | | | | | |

| x | | | |

x | No fee required. |

| o | | | Fee paid previously with preliminary materials. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| (1) | | Title of each class of securities to which transaction applies: |

| | | |

| (2) | | Aggregate number of securities to which transaction applies: |

| | | |

| (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| (4) | | Proposed maximum aggregate value of transaction: |

| | | |

| (5) | | Total fee paid: |

| | | |

| | | |

o | Fee paid previously with preliminary materials. |

| | | |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| | | |

| (1) | | Amount previously paid: |

| | | |

| (2) | | Form, Schedule or Registration Statement No: |

| | | |

| (3) | | Filing party: |

| | | |

| (4) | | Date Filed: |

| | | |

April 25, 2024

TO OUR STOCKHOLDERS:

You are cordially invited to attend the 2024 annual meeting of stockholders of Surgery Partners, Inc., to be held on June 6, 2024, at 2:00 p.m. (Central Daylight Time). The annual meeting will be held solely by remote communication in a virtual meeting format. If you attend the annual meeting virtually by following the instructions set forth in the proxy materials, you will be considered present at the meeting.

In accordance with rules adopted by the Securities and Exchange Commission, we are mailing to many of our stockholders a Notice of Internet Availability of Proxy Materials instead of a paper copy of the Proxy Statement, the proxy card and our Annual Report to Stockholders. The Notice of Internet Availability of Proxy Materials contains instructions on how stockholders can access the proxy materials over the internet as well as request a paper or email copy if desired.

It is important that your shares be represented at the annual meeting. Whether or not you plan to attend the annual meeting, we would greatly appreciate your efforts to vote your shares as soon as possible by following the instructions located in the Notice of Internet Availability of Proxy Materials or in our proxy statement. If you attend the annual meeting and wish to vote at that time, you may withdraw your proxy and vote your shares personally.

Sincerely,

/s/ Wayne S. DeVeydt

Wayne S. DeVeydt

Executive Chairman of the Board of Directors

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

MAY 3, 2016APRIL 25, 2024

DATE: May 3, 2016June 6, 2024

TIME: 9:2:00 a.m.p.m. CDT

PLACE: Corporate Headquarters (principal executive office)The annual meeting will be held solely by remote communication in a virtual meeting format. You will be able to

40 Burton Hills Boulevardattend the annual meeting by visiting www.meetnow.global/MFATQXS and entering the 15-digit control number found on the proxy card or voting instruction form. If you attend the annual meeting virtually, you will be considered present at the meeting.

Suite 500

Nashville, Tennessee 37215

ITEMS OF BUSINESS:

| |

1. | To elect the Class I director nominee for a term of three years |

| |

2. | To ratify the appointment of Ernst & Young, LLP as our independent registered public accounting firm for fiscal 2016; and |

| |

3. | To transact any other business that may properly come before the meeting. |

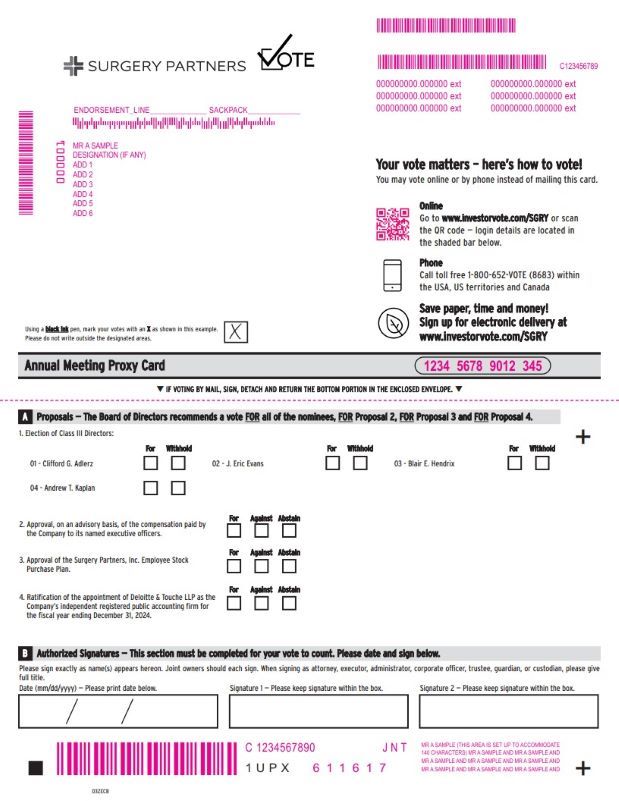

1.To elect the four Class III director nominees named in this Proxy Statement to the Board of Directors of Surgery Partners, Inc. (the "Company") for a term of three years;

2.To approve, on an advisory basis, the compensation paid by the Company to its named executive officers;

3.To approve the Surgery Partners, Inc. Employee Stock Purchase Plan (the "ESPP");

4.To ratify the appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2024; and

5.To consider and act upon any other business that may properly come before the 2024 annual meeting of stockholders and at any adjournment or postponement thereof.

Information relating to the matters to be considered and voted on at the annual meeting is set forth in the enclosed proxy materials.

RECORD DATE: Holders of shares of our common stock of record at the close of business on March 14, 2016April 8, 2024 are

entitled to receive notice of and vote at the annual meeting.meeting and at any adjournment or postponement thereof.

ANNUAL REPORT: The Company’sCompany's Annual Report to Stockholders for the fiscal year ended December 31, 2015 (the2023 is available to you on the internet or, upon request, will be delivered to you by mail or email.

“2015 Annual Report”), which is not part of the proxy soliciting materials, is enclosed.

PROXY VOTING: ItYour vote is important that your shares be representedimportant. Whether or not you plan to attend the annual meeting, after reviewing the proxy materials, please vote by phone or online following the instructions set forth in the following proxy materials, or if you requested a printed copy, please complete, date, sign and voted at the meeting. You can vote your

shares by completing and returningreturn the proxy card sent to you.in the enclosed stamped envelope. You can revoke a proxy at any time

prior to its exercise at the annual meeting by following the instructions in the attached Proxy Statement.

Whether or not If you plan to attend the meeting, your vote is important. After reviewing the proxy materials, please COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD in the enclosed stamped envelope in order that as many shares as possible will be represented. To obtain directionsdecide to attend the annual meeting and wish to change your proxy, you may do so by voting during the meeting.

The Board of Directors unanimously recommends that you vote: (i) "FOR" the election of the four Class III director nominees named in the Proxy Statement, (ii) "FOR" the approval, on an advisory basis, of the compensation paid by the Company to its named executive officers, (iii) "FOR" the approval of the ESPP, and (iv) "FOR" ratification of the Audit Committee’s appointment of Deloitte & Touche LLP as the Company's independent registered public accounting firm.

You are welcome to attend the annual meeting by visiting www.meetnow.global/MFATQXS and entering the 15-digit control number found on the proxy card or voting instruction form. Once admitted, you may submit questions, vote or view our list of stockholders during the annual meeting by following the instructions that will be available on the meeting website.

If you hold your shares through an intermediary, such as a bank or broker, you must register in person,advance to attend the annual meeting virtually on the internet. To register to attend the annual meeting online by webcast you must submit proof of your proxy power (legal proxy) reflecting your Company holdings along with your name and email address to Computershare, Inc.

(a subsidiary of Computershare Trust Company, N.A.), the Company’s transfer agent. Requests for registration must be labeled as “Legal Proxy” and be received no later than 4:00 p.m., Central Daylight Time, on June 3, 2024. You will receive a confirmation of your registration by email after we receive your registration materials.

Even if you plan to attend, please vote your shares promptly to ensure they are represented at the annual meeting. If you decide to attend the annual meeting and wish to change your proxy, you may do so by voting virtually at the meeting. If you have questions about how to attend the annual meeting, please contact Investor Relations at 40 Burton Hills Boulevard,340 Seven Springs Way, Suite 500, Nashville,600, Brentwood, Tennessee 37215,37027, (615) 234-5900.234-5900 or email ir@surgerypartners.com.

The Board of Directors recommends a vote FOR the election of the director nominee, and a vote FOR ratification of the appointment of Ernst & Young, LLP as the Company’s independent registered public accounting firm.

Each outstanding share of the Company’s common stock (the “common stock”) (NASDAQ: SGRY) entitles the holder of record at the close of business on March 14, 2016 to receive notice of and to vote at the annual meeting or any adjournment or postponement of the annual meeting.

At the annual meeting, you will have an opportunity to ask questions about the Company and its operations. You may attend the annual meeting and vote your shares in person even if you vote by returning your proxy card. Your proxy may be revoked by sending in another signed proxy card with a later date, sending a letter revoking your proxy to the Company’s General Counsel and Secretary in Nashville, TN, or attending the annual meeting and voting in person.

We look forward to seeing you. Thank you for your ongoing support of and interest in Surgery Partners, Inc.

By Order of the Board of Directors,

Michael T. Doyle/s/ Wayne S. DeVeydt

Chief

Wayne S. DeVeydt

Executive OfficerChairman of the Board of Directors

Nashville,

Brentwood, Tennessee

March 29, 2016April 25, 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 6, 2024:

THE PROXY STATEMENT, THE PROXY CARD AND OUR ANNUAL REPORT TO STOCKHOLDERS FOR THE FISCAL YEAR ENDED DECEMBER 31, 2023 ARE AVAILABLE TO YOU ON THE INTERNET AT WWW.INVESTORVOTE.COM/SGRY AND ON THE "INVESTORS" PAGE OF OUR WEBSITE AT WWW.SURGERYPARTNERS.COM OR, UPON YOUR REQUEST WILL BE DELIVERED TO YOU BY MAIL OR EMAIL, IN CONNECTION WITH THE SOLICITATION OF PROXIES BY THE BOARD OF DIRECTORS OF THE COMPANY TO BE VOTED ON AT THE ANNUAL MEETING. THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS IS SCHEDULED TO BE DISTRIBUTED ON OR ABOUT APRIL 25, 2024 TO STOCKHOLDERS OF RECORD AS OF THE CLOSE OF BUSINESS ON APRIL 8, 2024.

| | | | | |

| Page |

| |

| Page |

| |

Important Information About the Annual Meeting and VotingIMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING | |

| |

Explanatory NoteSECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | |

| |

Security Ownership of Certain Beneficial Owners and ManagementPROPOSAL NO. 1: ELECTION OF DIRECTORS | |

Section 16(a) Beneficial Ownership Reporting ComplianceCORPORATE GOVERNANCE | |

| |

Proposal No. 1: Election of DirectorsPROPOSAL NO. 2: ADVISORY VOTE ON EXECUTIVE COMPENSATION | |

| |

Corporate GovernanceEXECUTIVE OFFICERS | |

Director IndependenceCOMPENSATION DISCUSSION AND ANALYSIS | |

Board Leadership StructureREPORT OF THE COMPENSATION COMMITTEE | |

Selection of New DirectorsEXECUTIVE COMPENSATION | |

Board Meeting AttendanceDIRECTOR COMPENSATION | |

Board's Role in Risk OversightPROPOSAL NO. 3: APPROVAL OF EMPLOYEE STOCK PURCHASE PLAN | |

Committees of the BoardPROPOSAL NO. 4: RATIFICATION OF THE AUDIT COMMITTEE'S APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

Audit CommitteeFEES PAID TO INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

Compensation CommitteeREPORT OF THE AUDIT COMMITTEE | |

Contacting the BoardRELATED PERSON TRANSACTIONS | |

| |

Executive OfficersGENERAL MATTERS | |

| |

Executive CompensationAPPENDIX A - EMPLOYEE STOCK PURCHASE PLAN | |

Overview | |

Summary Compensation Table | |

Narrative to Summary Compensation Table | |

Outstanding Equity Awards at Fiscal Year-End | |

| |

Director Compensation | |

| |

Equity Compensation Plan Information | |

Surgery Partners, Inc. 2015 Omnibus Incentive Plan | |

| |

Proposal No. 2: Ratification of the Appointment of the Independent Registered Public Accounting Firm | |

| |

Fees Paid to Independent Registered Public Accounting Firm | |

| |

Report of the Audit Committee | |

| |

Related Person Transactions | |

| |

Code of Conduct | |

| |

Other Matters | |

| |

Annual Report on Form 10-K | |

SURGERY PARTNERS, INC.

40 Burton Hills Boulevard340 Seven Springs Way, Suite 600

Suite 500Brentwood, Tennessee 37027

Nashville, Tennessee 37215

PROXY STATEMENT

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why is the Company soliciting my proxy?

The Board of Directors (the “Board”"Board") of Surgery Partners, Inc. (“("Surgery Partners,”" the “Company,” “we”"Company," "we," "us" or “us”"our") is soliciting your proxy to vote at the 20162024 annual meeting of stockholders (the "Annual Meeting") to be held solely by remote communication in a virtual meeting format on Thursday, June 6, 2024, at our corporate headquarters, located at 40 Burton Hills Boulevard, Suite 500, Nashville, Tennessee, 37215, on Tuesday, May 3, 2016, at 9:2:00 a.m.p.m. Central Daylight Time (CDT) and any adjournments of the annualAnnual Meeting.

How can I attend the Annual Meeting?

The Annual Meeting will be conducted exclusively by webcast. You are entitled to participate in the Annual Meeting only if you were a stockholder of the Company as of the close of business on April 8, 2024 (the "Record Date"), or if you hold a valid proxy for the Annual Meeting. No physical meeting whichwill be held.

You will be able to attend the Annual Meeting online and submit your questions during the meeting by visiting www.meetnow.global/MFATQXS and entering the 15-digit control number found on the proxy card or voting instruction form. You also will be able to vote your shares online by attending the Annual Meeting by webcast.

To participate in the Annual Meeting, you will need to review the information included on your Notice, on your proxy card or on the instructions that accompanied your proxy materials.

If you hold your shares through an intermediary, such as a bank or broker, you must register in advance using the instructions below.

The virtual meeting will begin promptly at 2:00 p.m. Central Daylight Time (CDT). We encourage you to access the meeting prior to the start time leaving ample time for the check in. Please follow the registration instructions as outlined in this proxy statement.

Do I need to register to attend the Annual Meeting virtually on the Internet?

If you are a registered stockholder (i.e., you hold your shares through our transfer agent, Computershare), you do not need to register to attend the Annual Meeting virtually on the Internet. Please follow the instructions on the notice or proxy card that you received.

If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to attend the Annual Meeting virtually on the internet. To register to attend the Annual Meeting online by webcast you must submit proof of your proxy power (legal proxy) reflecting your Company holdings along with your name and email address to Computershare, Inc. (a subsidiary of Computershare Trust Company, N.A.), the Company’s transfer agent. Requests for registration must be labeled as “Legal Proxy” and be received no later than 4:00 p.m., Central Daylight Time, on June 3, 2024. You will receive a confirmation of your registration by email after we referreceive your registration materials.

Requests for registration should be directed to asus at the annualfollowing:

By email

Forward the email from your broker, or attach an image of your legal proxy, to legalproxy@computershare.com

By mail

Computershare

Surgery Partners, Inc. Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

If you attend the Annual Meeting virtually, you will be considered present at the meeting.

What if I have trouble accessing the Annual Meeting virtually?

The virtual meeting platform is fully supported across browsers (MS Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most up-to-date version of applicable software and plugins. Please note that Internet Explorer is not a supported browser. Participants should ensure that they have a strong WiFi connection wherever they intend to participate in the meeting. We encourage you to access the meeting prior to the start time. For further assistance should you need it you may call Local 1-888-724-2416 or International +1 781-575-2748.

What proxy materials are available and how do I receive them?

This Proxy Statement, summarizes the purposes of the meetingproxy card and the information you need to know to vote at the annual meeting.

Why am I receiving these materials?

Our Board is providing these proxy materials to you through delivery of printed versions by mail in connection with our 2016 annual meeting of stockholders, which are scheduled to be sent to stockholders beginning March 29, 2016. Stockholders are invited to attend the annual meeting and are requested to vote on the proposals described in this Proxy Statement.

What is included in these materials?

These proxy materials include:

our Proxy Statement for the annual meeting;

our Proxy Card; and

our 2015 Annual Report to Stockholders which includes our Annualfor the year ended December 31, 2023 (the "Annual Report to Stockholders") are being made available to you on Form 10-K, including our audited consolidated financial statements.

What informationthe internet instead of mailing a printed copy of these materials to each stockholder. The Notice of Internet Availability of Proxy Materials (the "Notice of Internet Availability") is contained in these materials?

The information included in this Proxy Statement relates to the proposalsscheduled to be voteddistributed on ator about April 25, 2024. The Notice of Internet Availability contains instructions as to how stockholders may access and review the annual meeting,proxy materials on the voting process,internet, including information about how stockholders may vote by telephone or over the compensationinternet. You will not receive a printed or email copy of certainthese materials unless you make such a request by following the instructions on the Notice of our executive officers and our directors and certain other required information.Internet Availability.

What proposals will be voted on at the annual meeting?Annual Meeting?

There are twofour proposals scheduled to be voted on at the annual meeting:Annual Meeting:

•the election of the four Class IIII director nomineenominees named in this Proxy Statement for a 3-yearthree-year term (Proposal 1);;

•the approval, on an advisory basis, of the compensation paid by the Company to its named executive officers (Proposal 2);

•the approval of the Surgery Partners, Inc. Employee Stock Purchase Plan (the "ESPP") (Proposal 3); and

•the ratification of the Audit Committee’sCommittee's appointment of ErnstDeloitte & Young,Touche LLP ("Deloitte") as the Company’sCompany's independent registered public accounting firm for the fiscal 2016year ending December 31, 2024 (Proposal 2)4).

What is the Board’sBoard's voting recommendation?

The Board recommends that you vote your shares “FOR” "FOR" the election of the four Class I nomineeIII director nominees named in this Proxy Statement, "FOR" the approval, on an advisory basis, of the compensation paid by the Company to its named executive officers, "FOR"the Board,approval of the ESPP, and “FOR”"FOR" the ratification of the Audit Committee’sCommittee's appointment of Ernst & Young, LLPDeloitte as the Company’sCompany's independent registered public accounting firm.

firm for the fiscal year ending December 31, 2024.

1

Unless instructed to the contrary,If you submit a proxy but do not indicate any voting instructions, your shares represented by the proxies at the annual meeting will be voted “FOR” "FOR" the election of the nomineefour Class III director nominees named in this Proxy Statement, "FOR" the approval, on an advisory basis, of the compensation paid by the Company to its named executive officers, "FOR"the Boardapproval of the ESPP, and “FOR” Proposal 2. "FOR" the ratification of the Audit Committee's appointment of Deloitte as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2024.

What is the quorum requirement for the Annual Meeting?

The quorum requirement for holding the Annual Meeting and transacting business is a majority of the voting power of the outstanding shares entitled to be voted and present at the meeting. The shares may be present or represented by proxy at the Annual Meeting. Both abstentions and broker non-votes will be counted as present for the purpose of determining the presence of a quorum.

What shares owned by me can be voted?voted at the Annual Meeting?

All shares owned by you as of the close of business on March 14, 2016April 8, 2024 (the “Record Date”"Record Date") may be voted. You may cast one vote per share of common stock that you held on the Record Date. These include shares that are: (1) held directly in your name as the stockholder of record, and (2) held for you as the beneficial owner through a stockbroker, bank or other nominee. On the Record Date, Surgery Partners, Inc.the Company had 48,156,990127,101,670 shares of common stock issued and outstanding.

What is the difference between holding shares as a stockholder of record and as a beneficial owner?

Most stockholders of Surgery Partners, Inc.the Company hold their shares through a stockbroker,broker, bank or other nominee rather than directly in their own name. As summarized below, there are some differences between shares held of record and those owned beneficially.

Stockholder of Record

If your shares are registered directly in your name with the Company’sCompany's transfer agent, Computershare, Investor ServicesInc. (a subsidiary of Computershare Trust Company, N.A.), you are considered the stockholder of record with respect to those shares, and the proxy materials are being sent directly to you. As the stockholder of record, you have the right to grantdirect your votingvote by proxy directly to the persons named as proxy holders, Michael T. Doyle, the Company’s Chief Executive Officer, and Christopher Laitala, the Company’s Chairman of the Board, or to vote in person at the annual meeting.Annual Meeting.

Beneficial Owner

If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your broker, bank or nominee who is considered,the stockholder of record with respect to those shares, the stockholder of record.such shares. As the beneficial owner, you are invited to attend the annual meeting.Annual Meeting. You also have the right to direct your broker on how to vote these shares. Your broker or nominee should have enclosed a voting instruction card for you to direct your broker or nominee how to vote your shares. However, shares held in “street name”"street name" may be voted in person by you only if you obtain a signed proxy from the record holder (stock brokerage, bank or other nominee) giving you the right to vote the shares.

How can I vote my shares in person at the annual meeting?Annual Meeting?

Shares held directly in your name as the stockholder of record may be voted in person at the annual meeting. If you choose to vote your shares in person at the annual meeting, please bring proof of ownership ofAnnual Meeting, you may do so by visiting www.meetnow.global/MFATQXS and entering the Company’s common stock15-digit control number found on the record date, such as the legal proxy card or voting instruction card provided byform and following the instructions on the website for voting your broker, bank or nominee, or a proxy card as well as proof of identification.shares at the meeting. Even if you plan to attend the annual meeting,Annual Meeting, the Company recommends that you vote your shares in advance as described below so that your vote will be counted if you later decide not to attend the annual meeting.Annual Meeting.

How can I vote my shares without attending the annual meeting?Annual Meeting?

Whether you hold your shares directly as the stockholder of record or beneficially in “street"street name,”" you may direct your vote without attending the annual meetingAnnual Meeting by proxy. You can vote by following the instructions on the Notice of Internet Availability which includes information about how stockholders may submit proxies by telephone or over the internet. Alternatively, upon request, you can vote by proxy by mail via a proxy card by marking your selections on the proxy card, datedating and signsigning your name exactly as it appears on the proxy card and mailmailing the proxy card in the pre-paid envelope that will be provided to you. Mailed proxy cards must be received no later than May 2, 2016June 5, 2024 in order to be counted for the annual meeting.Annual Meeting.

Please

If you are a beneficial owner, follow the instructions provided on the proxy card or voting instruction card.card provided by your broker, bank or other intermediary. We urge you to review the proxy materials carefully before you vote.

Can I revoke my proxy or change my vote?

You may revoke your proxy or change your voting instructions prior to the vote at the annual meeting.Annual Meeting. You may enter a new vote by mailing a new proxy card or new voting instruction card bearing a later date (which will automatically revoke your earlier voting instructions). Your new vote must be received by 11:59 p.m. CDT on May 2, 2016.June 5, 2024. You may also enter a

new vote by attending the annual meetingAnnual Meeting and voting in person.during the meeting. Your attendance at the annual meeting in personAnnual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request.

How are votes counted?

In the election of the director nominee (Proposal 1),For Proposal 1, your vote may be cast “FOR” the"FOR" each Class III director nominee, or you may “WITHHOLD”"WITHHOLD" from voting. Shares voting “WITHHOLD”"WITHHOLD" have no effect on the election of directors.

For ProposalProposals 2, 3 and 4, your vote may be cast “FOR”"FOR" or “AGAINST”"AGAINST" or you may “ABSTAIN.”"ABSTAIN." If you “ABSTAIN”"ABSTAIN" on this proposal,one of these proposals, it has no effect on the same effect asoutcome.

How are abstentions and broker non-votes treated for determining a vote “AGAINST” the proposal.

If you sign your proxy card or broker voting instruction card with no further instructions, your shares will be voted as described below in “Abstentionsquorum and Broker Non-Votes.”

Abstentions and Broker Non-Votescounting votes?

Any shares represented by proxies that are marked to “ABSTAIN”"ABSTAIN" from voting on a proposal will be counted as present in determining whether we have a quorum. They will also be counted in determining the total number of shares entitled to vote on a proposal. Abstentions and, if applicable, broker non-votes will not be counted as votes “FOR” a director nominee. Accordingly, abstentions"FOR" or "AGAINST" any proposal, and accordingly are not counted for the purposepurposes of determining the number of votes cast in the election of directors.on any proposal.

If your shares are held in “street name”"street name" and you do not instruct your broker on how to vote your shares, your broker, in its discretion, may either leave your shares unvoted or, on routine matters, may use its discretionary authority to vote your shares on routine matters. Only Proposal 2 (ratifying the appointment of our independent registered public accounting firm) is considered a routine matter.shares. If your broker returns a proxy card but does not vote your shares, this results in a “broker"broker non-vote.” Broker" Generally, broker non-votes will be counted as presentoccur when

shares held by a broker for a beneficial owner are not voted with respect to a particular proposal because (i) the purpose of determining a quorum.broker has not received voting instructions from the beneficial owner and (ii) the broker lacks discretionary voting power to vote such shares.

Proposal 1 (election of the four Class IIII director nominee) is notnominees), Proposal 2 (approval, on an advisory basis, of the compensation paid by the Company to its named executive officers) and Proposal 3 (approval of the ESPP) are considered a routine matter,non-routine matters, and without your instruction, your broker cannot vote your shares. Because brokers do not haveshares on those proposals. Proposal 4 (ratifying the appointment of our independent registered public accounting firm) is considered a routine matter for which your broker has discretionary authority to vote on this proposal, broker non-votes will not be considered in determining the number of votes necessary for approval and, therefore, will have no effect on the outcome of the votes for Proposal 1. However,your shares. As a result, broker non-votes with respect to any proposal will be treated as shares present for purposes of determining a quorum at the annual meeting.Annual Meeting. Broker non-votes will not be counted as votes "FOR" or "AGAINST" any proposal, and accordingly are not counted for purposes of determining the number of votes cast on any proposal. Therefore, broker non-votes will have no effect on the outcome of any proposal.

What is the voting requirement to approve each of the proposals?

Proposal 1, Election of Director Nominee:Nominees: Under our plurality voting standard, the nomineefour nominees for director who receivesreceive the most votes will be elected. Therefore, if you do not vote for thea nominee, or you “withhold”"WITHHOLD" your vote for thea nominee, your vote will not count either “for”"FOR" or “against”"AGAINST" the nominee. Abstentions and broker non-votes will have no effect on the outcome of voting for directors.

Proposal 2, Advisory Vote on Executive Compensation: Under our majority voting standard, the approval, on an advisory basis, of the compensation paid by the Company to its named executive officers requires that the number of votes properly cast "FOR" the proposal (and present, in person or by proxy, at the Annual Meeting) exceed the number of votes cast "AGAINST" the proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

Proposal 3, Approval of Employee Stock Purchase Plan: Under our majority voting standard, the approval of the ESPP requires that the number of votes properly cast "FOR" the proposal (and present, in person or by proxy, at the Annual Meeting) exceed the number of votes cast "AGAINST" the proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal.

Proposal 4, Ratification of the Audit Committee’s Appointment of Independent Registered Public Accounting Firm:Firm: Under our majority voting standard, the ratification of the Audit Committee’s appointment of Ernst & Young, LLPDeloitte as our independent registered public accounting firm for fiscal 2016year 2024 requires that the affirmative votenumber of the votes properly case oncast "FOR" the proposal and(and present, in person or by proxy, at the annual meeting.Annual Meeting) exceed the number of votes cast "AGAINST" the proposal. Abstentions will have no effect on the same effect as a vote againstoutcome of this Proposal 2.4. Brokers, banks and other nominees have discretionary voting power with respect to this proposal, and therefore we do not expect broker non-votes with respect to this proposal.

What does it mean if I receive more than one proxy or voting instruction card?

It means your shares are registered differently or are in more than one account. For each proxy you receive, please submit your vote for each control number you have been assigned. Please provide voting instructions for all proxy and voting instruction cards you receive.

Where can I find the voting results of the annual meeting?Annual Meeting?

We will announce preliminary voting results at the annual meetingAnnual Meeting and publish preliminary, or final results if available, in a Current Report on Form 8-K within four business days of the annual meeting.Annual Meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended report on Form 8-K to disclose the final voting results within four business days after the final voting results are known.

What happens if additional proposals are presented at the annual meeting?

Other than the twofour proposals described in this Proxy Statement, we do not expect any matters to be presented for a vote at the annual meeting.Annual Meeting. If you grant a proxy,other matters are properly presented to the stockholders for action at the Annual Meeting or any adjournments or postponements thereof, it is the intention of the persons named as proxy holders Michael T. Doyle,in the proxy card (J. Eric Evans, our Chief Executive Officer, and Christopher Laitala,Jennifer B. Baldock, our Chairman of the Board, will have the discretionExecutive Vice President and Chief Administrative and Development Officer) to vote yourin their discretion on all matters on which the shares on any additional matters properly presented for a vote at the annual meeting.represented by such proxy are entitled to vote. If for any unforeseen reason, any of the Company’s nomineeCompany's nominees is not available as a candidate for director, the persons named as proxy holders will vote your proxy for such other candidatecandidate(s) as may be nominated by the Board.

What is the quorum requirement for the annual meeting?

The quorum requirement for holding the annual meeting and transacting business is a majority of the voting power of the outstanding shares entitled to be voted and present at the meeting. The shares may be present in person or represented by proxy at the annual meeting. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum. Broker non-votes, however, are not counted as shares present and entitled to be voted with respect to the particular matter on which the broker has expressly not voted. Thus, broker non-votes will not affect the outcome of any of the matters being voted on at the annual meeting. Generally, broker non-votes occur when shares held by a broker for a beneficial owner are not voted with respect to a particular proposal because (1) the broker has not received voting instructions from the beneficial owner and (2) the broker lacks discretionary voting power to vote such shares.

Who will count the vote?

A representative of Computershare Investor Services will act as theAn inspector of election will be appointed to, among other things, tabulate all votes and certify the tabulator of the votes for bank, broker and other stockholder of record proxies.results.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed either within Surgery Partners Inc. or to third parties except (1)(i) as necessary to meet applicable legal requirements, (2)(ii) to allow for the tabulation of votes and certification of the vote and (3)(iii) to facilitate a successful proxy solicitation by the Board.

Additionally, we will forward to management any written comments you provide on a proxy card or through other means.

Who will bear the cost of soliciting proxies for the annual meeting?Annual Meeting?

Surgery Partners, Inc.The Company will pay the entire cost of soliciting proxies for the annual meeting,Annual Meeting, including costs for mailing the distributionNotice of Internet Availability, mailing printed proxy materials.materials upon request, and the solicitation of proxies. We have retained Computershare, Investor ServicesInc. to assist us with the distribution of the proxies and will pay their expenses. We will also reimburse brokers or nominees for the expenses that they incur for forwarding the proxies and any other proxy materials to their customers.proxies.

May I propose actions for consideration at next year’s annual meeting of stockholders or nominate individuals to serve as directors?You may submit proposals, including director nominations, for consideration at future annual stockholder meetings.

Stockholder Proposals: In order for a proposal by a stockholder of the Company to be eligible to be included in the Company’s proxy statement for the 2017 annual meeting of stockholders pursuant to the proposal process mandated by SEC rules, the proposal must be received by the Company on or before November 29, 2016 and must comply with the informational and other requirements set forth in Regulation 14A under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Under our Bylaws, and as permitted by SEC rules, certain procedures are provided that a stockholder must follow to nominate persons for election as directors or to introduce an item of business at an annual meeting of stockholders. These procedures provide that nominations for director nominees and/or an item of business to be introduced at an annual meeting of stockholders must be submitted in writing to the General Counsel and Secretary of Surgery Partners, Inc. at our principal executive office. We must receive the notice of your intention to introduce a nomination or proposed item of business at our 2017 annual meeting of stockholders no earlier than January 3, 2017, and no later than February 2, 2017.

If, however, the date of our 2016 annual meeting of stockholders is more than 30 days before or after the anniversary date of the annual meeting, we must receive notice on or before ten days after the day on which the date of our 2016 annual

meeting of stockholders is first disclosed in a public announcement.You may contact our General Counsel and Secretary at our principal execute office for a copy of the relevant Bylaw provisions regarding the requirements for making stockholder proposals and nominating director candidates.

How do I obtain a separate set of proxy materials if I share an address with other stockholders?

To reduce expenses, in some cases, we are delivering one set of the proxy materials to certain stockholders who share an address, unless otherwise requested by one or more of the stockholders. A separate proxy card will be included with the proxy materials for each stockholder. If you have only received one set of the proxy materials, you may request separate copies at no additional cost to you by calling us at (615) 234-5900 or by writing to us at Surgery Partners, Inc., 40 Burton Hills Boulevard, Suite 500, Nashville, Tennessee 37215, Attn: General Counsel and Secretary.

You may also request separate paper proxy materials for future annual meetings by following the instructions for requesting such materials in the materials, or by contacting us by calling or writing.

If I share an address with other stockholders of Surgery Partners, Inc., how can we get only one set of voting materials for future meetings?

You may request that we send you and the other stockholders who share an address with you only one set of proxy materials by calling us at (615) 234-5900 or by writing to us at Surgery Partners, Inc., 40 Burton Hills Boulevard, Suite 500, Nashville, Tennessee 37215, Attn: General Counsel and Secretary.

EXPLANATORY NOTE

We are an “emerging growth company” under applicable federal securities laws and therefore permitted to take advantage of certain reduced public company reporting requirements. As an emerging growth company, we provide in this Proxy Statement the scaled disclosure permitted under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, including the compensation disclosures required of a “smaller reporting company,” as that term is defined in Rule 12b-2 promulgated under the Securities Exchange Act of 1934. In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We will remain an “emerging growth company” until the earliest of (i) the last day of the fiscal year in which we have total annual gross revenues of $1 billion or more; (ii) December 31, 2020; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous three years; or (iv) the date on which we are deemed to be a large accelerated filer under the rules of the Securities and Exchange Commission, which means the market value of our common stock that is held by non-affiliates exceeds $700 million as of the prior June 30th.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information relating to the beneficial ownership of our common stock as of March 14, 2016,30, 2024 (except as otherwise indicated below), by:

•each person, or group of affiliated persons, known by us to beneficially own more than 5% of our outstanding shares of common stock;

•each of our named executive officers;

•each of our directors;directors and nominees; and

•all of our executive officers and directors as a group.

Information with respect to beneficial ownership in the following table is based on the Company's review of information furnished by or on behalf of each director, officer, or beneficial owner of more than 5% of our common stock and filed with the Securities and Exchange Commission (“SEC”). Beneficial ownership is determined in accordance with SEC rules. The information in the following table does not necessarily indicate beneficial ownership for any other purpose. In general, under theseSEC rules, a beneficial owner of a security includes any person who, directly or indirectly, through any contract, arrangement, understanding, relationship or otherwise has or shares voting power or investment power with respect to such security. A person is also deemed to be a beneficial owner of a security if that person has the right to acquire beneficial ownership of such security within 60 days. Except as otherwise indicated, and subject to applicable community property laws, the persons named in the table have sole voting and investment power with respect to all shares of common stock held by that person.

The percentage of shares of common stock beneficially owned is computed on the basis of 48,156,990127,101,670 shares of our common stock outstanding as of March 14, 2016.30, 2024. Shares of our common stock that a person has the right to acquire within 60 days of March 14, 201630, 2024 are deemed outstanding for purposes of computing the percentage ownership of such person’sperson's holdings, but are not deemed outstanding for purposes of computing the percentage ownership of any other person, except with respect to the percentage ownership of all directors and executive officers as a group. UnlessExcept as otherwise indicated below, and subject to applicable community property laws, we believe, based on information furnished by such persons, the address for each beneficial owner listed is c/o Surgery Partners, Inc., 40 Burton Hills Boulevard, Suite 500, Nashville, Tennessee 37215.

|

| | | | |

| Beneficial Owner | Number of Shares of Common Stock Beneficially Owned | Percentage of Common Stock Beneficially Owned |

| Beneficial owners of 5% or more of our common stock: | | |

H.I.G. Surgery Centers, LLC(1) | 26,455,651 |

| 54.9 | % |

Vaughan Nelson Investment Management, L.P.(2)

| 2,415,010 |

| 5.0 | % |

| Directors and Named Executive Officers: | | |

Michael T. Doyle(3) | 3,055,424 |

| 6.3 | % |

| Teresa F. Sparks | 145,851 |

| * |

|

| John Crysel | 89,755 |

| * |

|

| Dennis Dean | 89,755 |

| * |

|

| Jennifer Baldock | 56,097 |

| * |

|

Christopher Laitala(4) | — |

| — |

|

| Adam Feinstein | — |

| * |

|

Matthew I. Lozow(4) | — |

| — |

|

| Brent Turner | — |

| * |

|

| All executive officers and directors as a group (9 persons) | 3,436,882 |

| 7.1 | % |

* Represents beneficial ownership of less than 1% ofpersons named in the table have sole voting and investment power with respect to all shares of common stock.stock held by that person.

| | | | | | | | |

| Name of Beneficial Owner | Number of Shares of Common Stock Beneficially Owned | Percentage of Common Stock Beneficially Owned |

| | |

| Beneficial owners of 5% or more of our common stock: | | |

Bain Capital Investors, LLC (1) | 49,946,972 | | 39.3 | % |

FMR LLC (2) | 18,331,455 | | 14.4 | % |

Wellington Group (3) | 8,318,176 | | 6.5 | % |

The Vanguard Group (4) | 7,417,609 | | 5.8 | % |

| Directors and Named Executive Officers: | | |

Wayne S. DeVeydt (5) | 1,190,970 | | * |

J. Eric Evans (6) | 959,670 | | * |

Jennifer B. Baldock (7) | 383,144 | | * |

| David T. Doherty | 95,719 | | * |

| Bradley R. Owens | 78,338 | | * |

Brent Turner (8) | 65,908 | | * |

| Teresa DeLuca, M.D. | 52,160 | | * |

| Clifford G. Adlerz | 44,403 | | * |

| Marissa A. Brittenham | 39,768 | | * |

| John A. Deane | 21,221 | | * |

| Patricia A. Maryland, Dr.PH | 11,552 | | * |

Andrew T. Kaplan (9) | — | | — | |

T. Devin O'Reilly (9) | — | | — | |

Blair E. Hendrix (9) | — | | — | |

All executive officers and directors as a group (18 persons) (10) | 3,032,517 | | 2.3 | % |

_______

* Less than one percent.

(1)H.I.G. Surgery Centers,Bain Capital Investors, LLC an affiliate("BCI") is the sole member of H.I.G. Capital,(i) BCPE Seminole GP LLC, (“H.I.G.”a Delaware limited liability company ("BCPE GP"), holds 26,455,651 shares.which is the general partner of each of BCPE Seminole Holdings LP, a Delaware limited partnership (“BCPE Seminole”), and BCPE Seminole Holdings IV, L.P., a Cayman Islands exempted limited partnership (“BCPE Seminole IV”), (ii) BCPE Seminole GP II LLC, a Delaware limited liability company (“BCPE Seminole GP II”), which is the general partner of BCPE Seminole Holdings II Intermediate LP, a Delaware limited partnership (“BCPE Seminole II”), and (iii) BCPE Seminole GP III LLC, a Delaware limited liability company (“BCPE Seminole GP III”), which is the general partner of BCPE Seminole Holdings III, L.P., a Cayman Island exempted limited partnership (“BCPE Seminole III”). Each of BCPE Seminole, BCPE Seminole II, BCPE Seminole III and BCPE Seminole IV has shared voting and dispositive power over 10,708,102 shares of common stock, 30,055,197 shares of common stock, 4,232,353 shares of common stock and 4,951,320 shares of common stock, respectively. By virtue of the relationships described in this footnote, BCI may be deemed to share voting and dispositive power with respect to the securities held by BCPE Seminole, BCPE Seminole II, BCPE Seminole III and BCPE Seminole IV. Information reported in this table and the notes hereto in respect of BCI is based solely on Amendment No. 7 to Schedule 13D filed with the SEC on December 21, 2023 by BCI. The principal business address of H.I.G. Surgery Centers,each of BCI, BCPE Seminole, BCPE Seminole II, BCPE Seminole III and BCPE Seminole IV is 200 Clarendon Street, Boston, MA 02116.

(2)FMR LLC is c/o H.I.G. Capital, LLC, 1450 Brickell Avenue, 31st Floor, Miami, Florida 33131.

(2) The information relating to("FMR") has sole voting power over 18,220,445 shares of common stock and sole dispositive power over 18,331,455 shares of common stock. Information reported in this table and the Vaughan Nelson Investment Management, L.P.notes hereto in respect of FMR is based solely on athe Schedule 13G13G/A filed with the SEC on February 10, 2016, reporting beneficial ownership at December 31, 2015. Vaughan Nelson Investment Management, L.P., an affiliate of Vaughan Nelson Investment Management, Inc., holds 2,415,010 shares.9, 2024 by FMR. The principal business address of Vaughan NelsonFMR is 245 Summer Street, Boston, MA 02210.

(3)Wellington Management Group LLP, Wellington Group Holdings LLP and Wellington Investment Management, L.P. is 600 Travis Street, Suite 6300, Houston, Texas 77002.

(3) A portion of Mr. Doyle’sAdvisors Holdings LLP (the "Wellington Group") has shared voting power over 7,477,563 shares of common stock of Surgery Partners, Inc. is held in trust for the benefit of his immediate family.

(4) Christopher Laitala and Matthew I. Lozow, who are directors on our board, are affiliated with H.I.G. Capital, LLC. Neither has voting or investmentshared dispositive power over 8,318,176. Wellington Management Company LLP ("Wellington Management Company" together with the Wellington Group, "Wellington") has shared voting power over 7,453,887 shares of common stock and disclaimsshared dispositive power over 8,012,137 shares of common stock. Information reported in this table and the notes hereto in respect of Wellington is based solely on the Schedule 13G/A filed with the SEC on February 2, 2024 by Wellington. The principal business address of Wellington is c/o Wellington Management Company LLP, 280 Congress Street, Boston MA 02210.

(4)The Vanguard Group - 23-1945930 ("Vanguard") has sole voting power over 129,823 shares of common stock, shared dispositive power over 206,275 shares of common stock and sole dispositive power over 7,211,334 shares of common stock. Information reported in this table and the notes hereto in respect of Vanguard is based solely on the Schedule 13G/A filed with the SEC on February 13, 2024 by Vanguard. The principal business address of Vanguard is 100 Vanguard Blvd., Malvern, PA 19355.

(5)Mr. DeVeydt's beneficially owned shares include 890,000 shares of common stock underlying stock options and 200,000 shares of common stock underlying stock-settled stock appreciation right ("SSAR") awards, each of which is exercisable within 60 days of March 30, 2024.

(6)Mr. Evans' beneficially owned shares include 500,000 shares of common stock underlying stock options exercisable within 60 days March 30, 2024.

(7)Ms. Baldock's beneficially owned shares include 199,500 shares of common stock underlying stock options exercisable within 60 days of March 30, 2024.

(8)Mr. Turner's beneficially owned shares include 4,015 shares of common stock underlying stock options exercisable within 60 days of March 30, 2024.

(9)The shares beneficially owned by each of Messrs. O'Reilly, Kaplan and Hendrix do not include shares held by BCI. Mr. O'Reilly, Mr. Kaplan and Mr. Hendrix are each a Partner of BCI and as a result, by virtue of the relationships described in footnote (1) above, may each be deemed to share beneficial ownership of H.I.G. Capital, LLC. The addressthe shares of both is c/o H.I.G. Capital, LLC, 600 Fifth Avenue, New York, New York 10020.common stock held by BCI.

(10)Includes 1,942,015 shares of common stock underlying stock options and SSAR awards exercisable within 60 days of March 30, 2024.

Delinquent Section 16(a) Beneficial Ownership Reporting ComplianceReports

Section 16(a) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), requires our executive officers and directors and persons who own more than 10% of a registered class of our equity securities to file initial reports of ownership and reports of changes in ownership with the SEC. Such persons are required by regulation of the SEC to furnish us with copies of all Section 16(a) forms they file. Based solely on our review of the copies of such forms or written representations from certain reporting persons received by us with respect to fiscal year 2015,2023, we believe that our executive officers and directors and persons who own more than 10% of a registered class of our equity securities have complied with all applicable filing requirements.requirements with respect to fiscal year 2023, except for (i) filing of a Form 3 upon the appointment of Ms. Burkhalter to Chief Human Resources Officer on January 29, 2023 that was inadvertently filed late on March 6, 2023, (ii) the sale of shares on August 29, 2023 to satisfy the tax withholding obligations in connection with a vesting event on August 28, 2023 for Mr. Doherty that was inadvertently reported late on a Form 4

report filed on September 1, 2023, and (iii) restricted stock awards granted to Drs. DeLuca and Maryland and Messrs. Turner, Deane and Adlerz on June 1, 2023 that were inadvertently reported late on Form 4 reports filed on April 5, 2024.

PROPOSAL NO. 1: ELECTION OF DIRECTORS

In accordance with the Company’s certificateCompany's Amended and Restated Certificate of incorporationIncorporation (the "charter") and Amended and Restated Bylaws (the "bylaws"), the Board is divided into three classes of approximately equal size. The members of each class are elected to serve a three-year term with the term of office of each class ending in successive years. Adam Feinstein is aClifford G. Adlerz, J. Eric Evans, Blair E. Hendrix and Andrew T. Kaplan are Class I directorIII directors whose term expiresterms expire at the Company's 2016 annual meeting of stockholders. Mr. Feinstein hasAnnual Meeting.

Messrs. Adlerz, Evans, Hendrix and Kaplan have been nominated for and hashave agreed to stand for re-election to the Board toas Class III directors. The Class III directors will serve as a Class I directorterm of the Company for three years and until his successor is duly elected and qualified or until his death, resignation or removal, whichever is earliest to occur.

The nomineefour nominees for director with the highest number of affirmative votes will be elected as a Class I director. UnlessIII directors. Except with respect to broker non-votes, unless you otherwise instruct, proxies will be voted for election of the nominee who isnominees listed above as director nominee.nominees. The Company has no reason to believe that any nominee will be unable to serve, but in the event that thea nominee is unwilling or unable to serve as a director and the Board does not, in that event, choose to reduce the size of the Board, the persons voting the proxy may vote for the election of another person in accordance with their judgment.

THE BOARD UNANIMOUSLY RECOMMENDS THAT YOU VOTE "FOR" EACH OF THE ABOVE-NAMED NOMINEES FOR CLASS III DIRECTORS.

The Board unanimously recommends that you vote for this nominee for Class Ifollowing table sets forth the name, age (as of March 30, 2024) and position of individuals who currently serve as a director and proxies solicited byof the Board will be voted in favor thereof unless a stockholder has indicated otherwise on the proxy.Company.

Director Standing for Election | | | | | | | | |

| Name | Age | Position |

| John A. Deane | 62 | Class I Director |

| Teresa DeLuca, M.D. | 58 | Class I Director |

| Wayne S. DeVeydt | 54 | Class I Director, Chairman |

| Patricia A. Maryland, Dr.PH | 70 | Class II Director |

| T. Devin O'Reilly | 49 | Class II Director |

| Brent Turner | 58 | Class II Director |

| Clifford G. Adlerz | 70 | Class III Director |

| J. Eric Evans | 47 | Class III Director |

| Blair E. Hendrix | 59 | Class III Director |

| Andrew T. Kaplan | 39 | Class III Director |

Information concerning our nominees and directors is set forth below. The biographical description of each director includes the specific experience, qualifications, attributes and skills that the board of directorsBoard would expect to consider if it were making a conclusion currently as to whether such person should serve as a director.

Adam Feinstein

Class III Director Nominees for Election

Clifford G. Adlerz has served as Directora director of Surgery Partners Inc. since August 2015.October 2017. Mr. Feinstein co-founded Vesey Street CapitalAdlerz previously served as a Consultant to Surgery Partners L.L.C.from February 2018 until May 2019 and Interim Chief Executive Officer of Surgery Partners from September 2017 until January 2018. Before his time at Surgery Partners, Mr. Adlerz held several management roles at Symbion, Inc., a healthcare services private equity fund,large multi-specialty provider of ambulatory surgery centers and hospitals, including as President from May 2002 until Symbion was acquired by Surgery Partners in 2014 and has been a Managing Partner since that time. From 2012November 2014. Prior to 2014,joining Symbion, Mr. FeinsteinAdlerz served as the SeniorDivision Vice President of Corporate Development, Strategic Planning and OfficeHCA, a healthcare facilities operator, as well as Regional Vice President of Midsouth HealthTrust. Mr. Adlerz currently serves on the CEO at LabCorp and prior to thatBoard of Directors of Ovation Fertility. Mr. Adlerz previously served as a Managing Directordirector for the National Ambulatory Surgery Center Association and was part of the leadership group for ASC Quality Collaboration. Mr. Adlerz holds a B.A. in Business and an M.B.A. from the University of Florida. Our Board believes that Mr. Adlerz is qualified to serve as a director based on, among other things, his experience with the Company and its predecessor as well as in the healthcare industry generally and his general business and financial acumen.

J. Eric Evans has served as a director of Surgery Partners since January 2020. Mr. Evans is currently Chief Executive Officer of Surgery Partners, a role he has held since January 2020, and previously served as Executive Vice President and Chief Operating Officer of Surgery Partners from April 2019 until January 2020. Prior to joining Surgery Partners, Mr. Evans served as President of Hospital Operations of Tenet Healthcare Corporation from March of 2016 through 2018 as Chief Executive Officer of Tenet Healthcare Corporation’s former Texas region from April 2015 to March 2016, and as Market Chief Executive Officer of The Hospitals of Providence in El Paso from September 2012 to April 2015. Mr. Evans has served as a director of QuVa Pharma since March 2022 and of Teledoc Health since September 2023. Mr. Evans holds a bachelor’s degree in industrial management from Purdue

University and an M.B.A. from Harvard Business School. Our Board believes that Mr. Evans is qualified to serve as a director based on his service as our Chief Executive Officer and his prior experience serving as an executive in the healthcare industry.

Blair E. Hendrix has served as a director of Surgery Partners since May 2021. Mr. Hendrix joined Bain Capital Private Equity Research at Barclays Capital.in 2000 and currently serves as a Partner. Prior to joining Bain Capital, Mr. Hendrix was Executive Vice President and Chief Operating Officer of DigiTrace Care Services, Inc. (now SleepMed), a national healthcare services company he co-founded. Earlier in his career, Mr. Hendrix was employed by Corporate Decisions, Inc. (now Oliver Wyman Consulting), a management consulting firm with a focus in healthcare. He has served on numerous corporate boards within Bain Capital and currently is a board member at ScribeAmerica,of the nation’s leading providerfirm’s Investment Committee for the Healthcare Vertical. Additionally, Mr. Hendrix has served as a director of medical scribes,US Renal Care since 2019. He previously served as a director of BMC Software, iHeart Media, Clear Channel Outdoor and Imedex,The Weather Company. Mr. Hendrix received an A.B. from Brown University. Our Board believes that Mr. Hendrix is qualified to serve as a leading providerdirector based on, among other things, his business and finance experience within the healthcare industry.

Andrew T. Kaplan has served as a director of accredited medical education.Surgery Partners since August 2018. Mr. FeinsteinKaplan joined Bain Capital Private Equity in 2009 and is a CFA charterholderPartner. Prior to joining Bain Capital Private Equity, Mr. Kaplan was an investment banker with Goldman Sachs. He also co-founded EngagedHealth, LLC, a post-hospitalization service for chronically ill, low income patients aiming to improve outcomes, reduce readmissions, and save costs. Mr. Kaplan has served on the Board of Directors for QuVa Pharma since 2015, US Renal Care since 2019 and InnovaCare Health since 2021. He previously served as a director of Beacon Health Options from 2018 to 2020. Mr. Kaplan holds a B.S. in BusinessEconomics from the SmithThe Wharton School at the University of Maryland at College Park. He also completed the Nashville Healthcare Council Fellows program.Pennsylvania and an M.B.A from Harvard Business School. Our Board believes that Mr. Kaplan is qualified to serve as a director based on, among other things, his experience in co-founding a healthcare company and his general financial experience.

Directors Continuing in Office

Class III Directors. The following directors have terms ending in 2017:2025:

Christopher Laitala

John A. Deane has served as Director of Surgery Center Holdings, Inc. since 2009, Directora director of Surgery Partners Inc. since May 2019. Mr. Deane served as the Chairman of the Advisory Board Company from December 2009 until April 20152018. Prior to joining the Advisory Board Company, he was the Founder and ChairmanChief Executive Officer of Southwind Health Partners, LLC, a start-up health care business focused on providing management services for hospital and health system sponsored medical groups, from October 1998 until December 2009. Following his health care career, Mr. Deane has served on several not-for-profit boards and as the owner/operator of a boutique resort and marina outside of Nashville, Tennessee. Mr. Deane holds a B.A. in Political Science and a M.P.A from American University. Our Board believes that Mr. Deane is qualified to serve as a director based on, among other things, his extensive experience working with physicians in the healthcare industry.

Teresa DeLuca, M.D., MBA has served as a director of Surgery Partners since August 2015. Mr. Laitala joined H.I.G. Capital in 2002 and is nowSeptember 2016. Dr. DeLuca served as a Managing Director at Columbia University's NY Life Science Venture Fund from January 2018 until January 2020 and continues to serve as a Faculty Advisor at the University’s School of Entrepreneurship and Faculty Member of Columbia University School of Professional Studies. She previously served as Assistant Clinical Professor of Psychiatry at the Icahn School of Medicine at Mount Sinai in New York City from 2014 to 2017 and as the Chief Medical Officer of Magellan Pharmacy Solutions at Magellan Health from 2012 to 2014. Prior to that, she served as SVP of Pharmacy Health Solutions at Humana, National Medical Director & VP of Clinical Sales Solutions at Walgreen Co., VP of Personalized Medicine, and VP of Medical Policy & Clinical Quality and CMO UHG at Medco. Prior to taking on these executive leadership roles, Dr. DeLuca was a Senior Director of Global Product Development Services at PRA International and a Senior Medical Scientist at GlaxoSmithKline. Dr. DeLuca serves as a director of Life Stance, a behavioral healthcare company, since 2024. She also serves as a director of Rejuveron, a private Swiss drug discovery company since March 2022. Previously, she served as a director of 180 Life Science, a biotechnology company, from May 2021 to December 2023. She also served as a director of North Bud Farms, Inc., a pharmaceutical commercialization company, from May 2018 to February 2020. Dr. DeLuca completed her residency (M.D.) at Jefferson Medical College of Thomas Jefferson University and earned her M.B.A. from Drexel University. Our Board believes that Dr. DeLuca is qualified to serve as a director based on- among other things- her healthcare knowledge, experience and skills gained from being physician with an active medical license, as well as previously serving as a Fortune 50 Chief Medical Officer and P&L business line owner. As a strong advocate for good board governance, Dr. DeLuca earned the Carnegie Mellon Cybersecurity Certificate in 2016 and passed the Digital Directors Network Cyber Risk Masterclass examination for Public Companies in 2022. Dr. DeLuca has continued to maintain good standing with the National Association of Corporate Directors (NACD) as a Board Leadership Fellow (Master Level) since 2016. Dr. DeLuca has also passed the NACD’s “Directorship Certified” examination (NACD.DC) in 2020. In 2023, she became a NACD “Subject Matter Expert” in examination development and a Board Advisory Faculty Member, and in 2024 began serving as a NACD Certification Commissioner. She has also earned the American College of Corporate Directors (ACCD) ) “Master Professional Director – Public Company” credential in 2021. Dr. DeLuca was named a “Director to Watch” in the New York office, where he has led investments2020 Directors & Board Annual Report and a “Featured Director of the Month” in 2022 by the Chief Executive Group. In 2022, Dr. DeLuca became Co-Chair and Leadership Council Member for the international organization, Women Corporate Directors (WCD) and was named in 2024 to “Who’s Who in America”.

Wayne S. DeVeydt is a number of industries including healthcare. Mr. Laitala has served on the board of directors of several H.I.G. companies. Prior to joining H.I.G., Mr. Laitala workedManaging Director with private equity firms including J.H. Whitney & Co.Bain Capital and Great Point Partners, LLC. Mr. Laitala holds an A.B. in Government from Harvard University and an M.B.A. from Harvard Business School.

Michael T. Doyle has served as the Chief Executive Officer and Directora director of Surgery Center Holdings, Inc.Partners since 2009,January 2018. Mr. DeVeydt currently is Executive Chairman of Surgery Partners, a role he has held since January 2020 and previously served as Chief Executive Officer of Surgery Partners Inc. since April 2015 and Directorfrom January 2018 until January 2020. From January 2017 until January 2018, Mr. DeVeydt served as a Senior Advisor to the Global Healthcare division of Surgery Partners, Inc. since August 2015. He has been withBain Capital Private Equity, the Company since 2004, previouslyinvestment advisor of BCPE Seminole Holdings LP, the Company's former controlling stockholder. From May 2007 to May 2016, Mr. DeVeydt served as Executive Vice President and Chief Operating Officer. PriorFinancial Officer of Anthem, Inc., a health insurance company. From March 2005 to that, Mr. Doyle worked at HealthSouth, Corporation, a large healthcare organization, for nine years whereMay 2007, he held a variety of leadership positions and leftserved as Anthem's Senior Vice President and Chief Accounting Officer and for a portion of Operations.that time, he also served as Chief of Staff to the Chairman. Prior to joining Anthem, Mr. Doyle holdsDeVeydt served as a partner at PricewaterhouseCoopers LLP, focused on companies in the national managed care and insurance industries. Mr. DeVeydt has served as a director of Centene Corporation, the largest Medicaid managed care organization in the United States, since January 2022. He has also served as a director of Zelis since August 2022. Mr. DeVeydt previously served as a director of Grupo Notre Dame Intermedica, Myovant Sciences Ltd, a biopharmaceutical company, and NiSource Inc., a utilities company. Mr. DeVeydt received his B.S. in PhysiotherapyBusiness Administration from Dalhousiethe University of Missouri in Halifax, Nova ScotiaSt. Louis. Our Board believes that Mr. DeVeydt is qualified to serve as a director based on his service as our Chief Executive Officer and his prior experience serving as an M.B.A. from Troy State University.executive in the healthcare industry.

Class IIIII Directors. The following directors have terms ending in 2018:2026:

Matthew I. Lozow

Patricia A. Maryland, Dr.PH. has served as Director of Surgery Center Holdings, Inc. since 2014 and as Directora director of Surgery Partners Inc. since April 2015. Mr. Lozow joined H.I.G. Capital in 2009February 2021. Dr. Maryland served as the Executive Vice President of Ascension and is nowPresident and Chief Executive Officer of Ascension Healthcare from July 2017 to July 2019. Prior to those roles, Dr. Maryland served with Ascension Healthcare as President, Healthcare Operations and Chief Executive Officer from July 2013 to July 2017 and Ministry Market Leader, Michigan from September 2007 to June 2013. Dr. Maryland has been a Managing Directormember of over 25 boards in the New York office.nonprofit, private, joint venture, and public sectors and has been the recipient of multiple awards, including being named one of the Top 25 COOs in Healthcare in 2017, one of the Top 25 Women in Healthcare in 2019, 2018, 2017, 2016 and 2015 by Modern Healthcare, Woman of the Year in 2014 by the Healthcare Businesswomen’s Association, and one of Modern Healthcare’s Top 25 Minority Executives in Healthcare also in 2014. Dr. Maryland received a bachelor’s degree in applied mathematics from Alabama State University, Montgomery, and a master’s degree in biostatistics from the University of California, Berkeley. She holds a Doctorate of Public Health from the University of Pittsburgh, concentrating in health services administration and planning. Our Board believes that Dr. Maryland is qualified to serve as a director based on, among other things, her experience in healthcare administration particularly with respect to her past leadership experiences.

T. Devin O'Reilly has served as a director of Surgery Partners since August 2017, including as Chairman from August 2017 to January 2020. Mr. O'Reilly joined Bain Capital Private Equity, LP ("Bain Capital Private Equity") in 2005 and and currently serves as a Partner. Prior to joining H.I.G.,Bain Capital Private Equity, Mr. Lozow worked withO'Reilly was a consultant at Bain & Company where he consulted for private equity firms including Audax Private Equity and began his careerhealthcare industries. Mr. O'Reilly has served as a consultant withdirector of Aveanna Healthcare since 2017, Zelis since 2019, PartsSource since 2021, and athenahealth and LeanTaaS since 2022. He previously served as a director of several Bain & Company.Capital portfolio companies including Bio Products Laboratory, Grupo Notre Dame Intermedica, and US Renal Care among others. Mr. LozowO'Reilly holds a B.S. in EngineeringB.A. from M.I.T.Princeton University and an M.B.A. from The Wharton School ofat the University of Pennsylvania.

Our Board believes that Mr. O’Reilly is qualified to serve as a director based on, among other things, his experience as an investor in other healthcare companies.

8

Brent Turnerhas served as Directora director of Surgery Partners Inc. since December 2015. Mr. Turner is currentlythe Chief Executive Officer and a member of the Board of Directors of Summit BHC, a leading inpatient behavioral healthcare company. Mr. Turner previously served as the President of Acadia Healthcare Company Inc (NASDAQ: ACHC), and has served as the President since joiningInc. from April 2012 until March 2019. Mr. Turner joined Acadia in 2011.February 2011 as a Co-President. Prior to joining Acadia, Mr. Turner served as the Executive Vice President, of Finance and Administration of Psychiatric Solutions, Inc. from August 2005 to November 2010 and prior to that, as the Vice President, Treasurer and Investor Relations and as a Division President. Mr. Turner currently serves on the Board of Trustees of the National Association of Behavioral Healthcare (NABH), and served as Chairman in 2018 and 2009. Mr. Turner previously served on the Board of Directors of LHC Group, Inc. (NASDAQ: LHCG) andfrom 2014 until February 2023 when the National Association of Psychiatric Health Systems (NAPHS).company was acquired by UnitedHealth Group. Mr. Turner holds a B.A. in Economics from Vanderbilt University and an M.B.A. from the Vanderbilt Owen Graduate School of Management. Our Board believes that Mr. Turner is qualified to serve as a director based on, among other things, his experience as an executive in the healthcare industry, his service as a board member of other publicly traded companies and his financial knowledge.

Board Diversity

Based upon voluntary self-identification by each member of our Board, the table below sets forth the diversity composition of our Board. Each of the categories listed in the table below has the meaning set forth in Nasdaq Rule 5605(f).

| | | | | | | | | | | | | | |

Board Diversity Matrix (1) |

| As of April 25, 2024 | As of April 20, 2023 |

| Total Number of Directors | 10 | 10 |

| Part I: Gender Identity | Female | Male | Female | Male |

| Directors | 2 | 8 | 2 | 8 |

| Part II: Demographic Background | | | | |

| African American or Black | 1 | 0 | 1 | 0 |

| White | 1 | 8 | 1 | 8 |

| | | | |

(1)Inapplicable categories omitted.

CORPORATE GOVERNANCE

Our Board currently consists of fiveten directors. At each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the directors of the same class whose terms are then expiring. The division of the three classes and their respective election dates are as follows:

•the Class I director’sdirectors' term will expire at the annual meeting of stockholders to be held in 2016 .2025;

•the Class II director’sdirectors' term will expire at the annual meeting of stockholders to be held in 2017.2026; and

•the Class III directors’directors' term will expire at the annual meeting of stockholders to be held in 2018. 2027;

Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our Board into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control.

Our amended and restated certificate of incorporationcharter provides that directors will be elected at the annual meeting of the stockholders and each director elected will hold office until his or her successor is elected and qualified. The size of the Board shall be fixed from time to timeis determined exclusively by a majority vote of the directors then in office and vacancies and newly created directorships on the Board withare filled exclusively by a maximum of 15 members, provided that, prior to the date H.I.G. (through one or more of its affiliates) ceases to beneficially own 50% or more of our common stock, the sizemajority of the Board will be determineddirectors then in office, even if less than a quorum, or by a sole remaining director, except in each case, that any vacancy created by the affirmativeremoval of a director by the stockholders for cause shall only be filled, in addition to any other vote of holdersotherwise required by law, by vote of a majority of our common stock. Directors will (except for the filling of vacancies and newly created directorships) be elected by the holders of a plurality of the votes cast by the holders of shares present in person or represented by proxy at the meeting andthen outstanding capital stock entitled to vote generally on the election of such directors.

The following table sets forth the name, age (as of March 14, 2016) and position of individuals who currently serve as the directors of Surgery Partners, Inc.

|

| | | |

Name | Age | Position |

Christopher Laitala | 43 |

| Class III Director, Chairman |

Michael T. Doyle | 43 |

| Class III Director, Chief Executive Officer |

Adam Feinstein | 44 |

| Class I Director |

Matthew I. Lozow | 38 |

| Class II Director |

Brent Turner | 51 |

| Class II Director |

Director Independence